If you haven't set an inactivity preference, Kiva may be required to send your funds to a state government if your account becomes inactive. It's therefore important to check your account's settings for 'Repayment', 'Inactivity' and 'Auto-Lending'.

Many Kiva loans are repaid in monthly installments, but if you are travelling, unwell or just very busy, you may not be able to check your Kiva credit after repayment day (which is usually about the 18th of the month). To avoid leaving money sitting idle when it could be used for another loan, and to control what happens to your Kiva credit when you depart this life, you can, as a precaution, set up Auto-Lending.

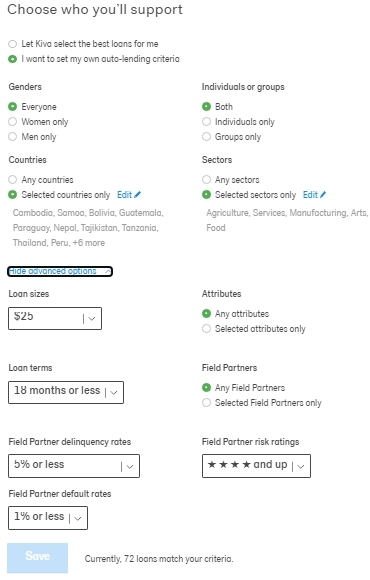

Auto-lending only happens if you fail to sign in within a certain number of days, which you specify. It can be up to 120 days. If you have $25 in credit but don't sign in, Kiva can act for you to allocate that credit to a new loan. You can control the choice of loans by setting criteria such as countries, sectors, risk rating, repayment term, gender, etc.

Here's what to do.

1. Sign in to Kiva, and (in the dropdown list near your profile photo) select 'Settings'.

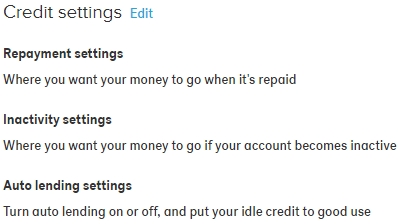

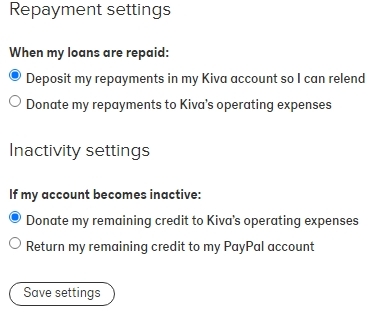

2. At 'Credit Settings', click 'Edit'.

3. Choose your preferences for 'Repayment settings' and 'Inactivity settings', then click 'Save settings'.

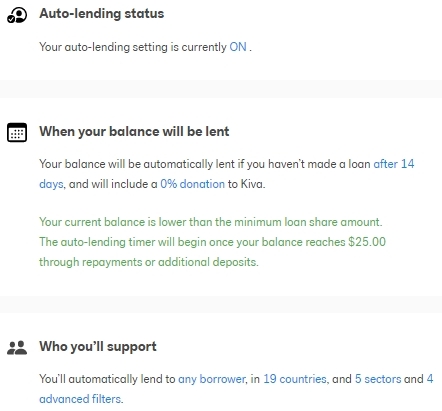

4. Check and adjust your Auto-Lending settings. Click on a link to change that particular setting (days, donation etc).

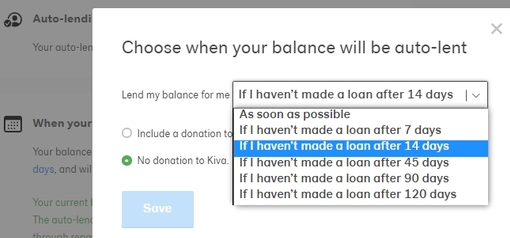

5. Choose when your balance would be auto-lent.

6. Specify what type of loans would be allocated if you don't log in to do it yourself within the time that you specified. Here's an example.

As I said, auto-lending only happens if you fail to sign in within the number of days that you specify. Please check your account settings! Do they suit the way you use Kiva now, and what you want to happen in the future?

~ ~ ~

Join Genealogists for Families. Together we can make a difference!